All about Estate Planning Attorney

All about Estate Planning Attorney

Blog Article

The Best Strategy To Use For Estate Planning Attorney

Table of ContentsSome Of Estate Planning AttorneyLittle Known Facts About Estate Planning Attorney.The 4-Minute Rule for Estate Planning AttorneyThe smart Trick of Estate Planning Attorney That Nobody is Discussing

Estate planning is an action strategy you can make use of to establish what occurs to your properties and obligations while you're to life and after you pass away. A will, on the various other hand, is a legal file that lays out just how assets are distributed, that deals with children and family pets, and any kind of other wishes after you die.

Insurance claims that are denied by the executor can be taken to court where a probate judge will certainly have the final say as to whether or not the insurance claim is legitimate.

The Main Principles Of Estate Planning Attorney

After the supply of the estate has been taken, the worth of properties computed, and tax obligations and financial debt settled, the administrator will certainly then seek authorization from the court to disperse whatever is left of the estate to the beneficiaries. Any type of inheritance tax that are pending will certainly come due within nine months of the day of death.

Each specific areas their properties in the trust fund and names someone other than their partner as the recipient., to sustain grandchildrens' education and learning.

The Single Strategy To Use For Estate Planning Attorney

Estate planners can function with the contributor in order to minimize gross income as an outcome of those payments or develop strategies that take full advantage of the impact of those contributions. This is an additional technique that can be used to restrict death tax obligations. It includes an individual securing in the present value, and hence tax responsibility, of their building, while associating the value of future development of that capital to an additional person. This approach includes cold the value of a property at its value on the day of transfer. Appropriately, the quantity of prospective resources gain at death is additionally frozen, permitting the estate planner to approximate their potential tax obligation liability upon fatality and better prepare for the payment of earnings tax obligations.

If adequate insurance policy earnings are readily available and the policies are appropriately structured, any earnings tax on the deemed personalities of assets complying with the fatality of a person can be paid without turning to the sale of properties. Proceeds from life insurance policy that are obtained by the beneficiaries upon the death of the insured click over here now are usually income tax-free.

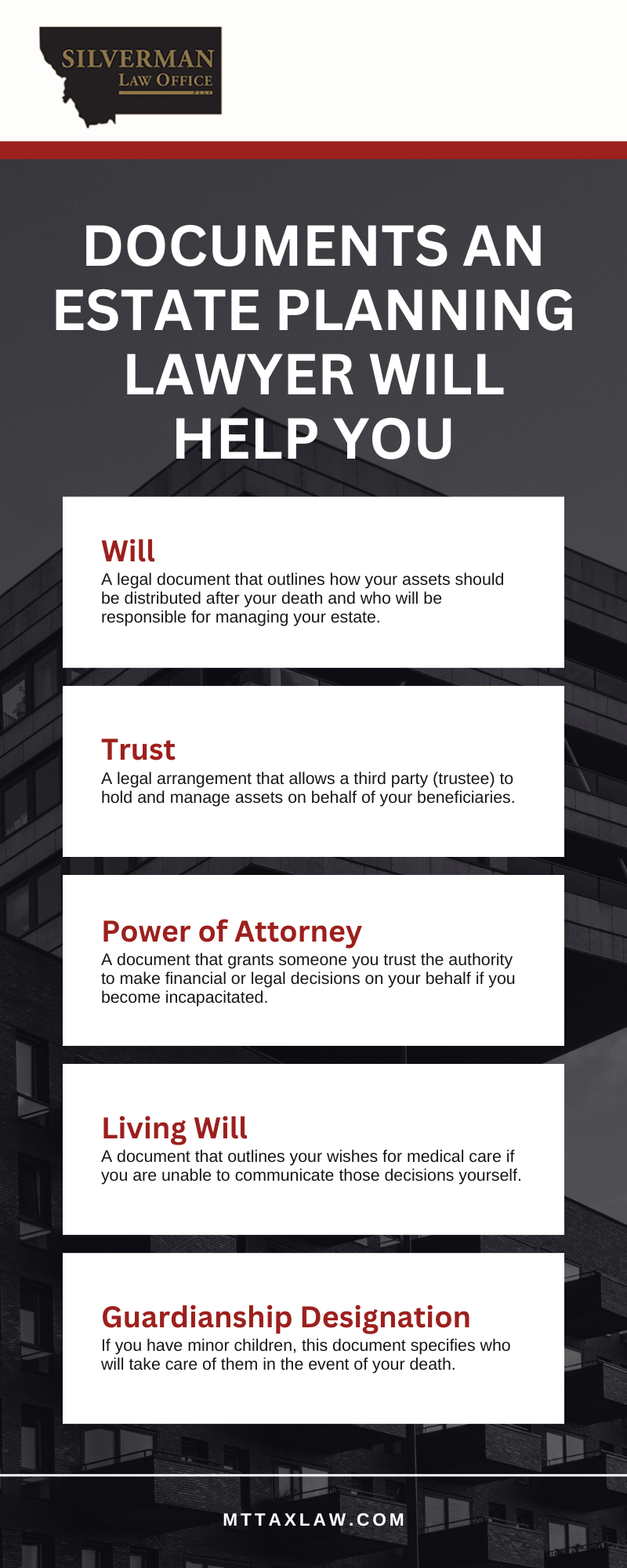

There are particular documents you'll need as part of the estate planning process. Some of the most common ones include wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning is only for high-net-worth individuals. Estate intending makes it less complicated for people to establish their desires before and after they die.

Getting The Estate Planning Attorney To Work

You ought to begin preparing for your estate as quickly as you have any kind of measurable asset base. It's a recurring process: as life proceeds, your estate plan should change to match your situations, in accordance with your brand-new goals. And maintain at it. Not doing your estate preparation can cause excessive financial worries to liked ones.

Estate planning is commonly thought of as a device for the well-off. However that isn't the instance. It can be a helpful method for you to manage official site your properties and responsibilities before and after you pass away. Estate planning is additionally an excellent way for you to set out prepare for the care of your minor kids and pet dogs and to outline your long for your funeral service and favored charities.

Qualified applicants who pass the test will be formally licensed in August. If you're eligible to rest for the exam from a previous application, you may submit the short application.

Report this page